The global COVID-19 pandemic and disagreements between Russia and Saudi Arabia caused a one-two punch to the oil prices back in March of 2020. This has created a glut in the oil Market creating disarray amongst OPEC leaders and investors with the futures prices turning negative in April of 2020 for the first time in history. As the economies around the world began to reopen and the OPEC members agreed oil supply cuts, the oil market stabilized with prices continuing to recover.

The MacroRisk Analytics® platform can assist financial advisors in identifying proxy investments, based on economic interactions, that are expected to behave similar to or opposite to oil investments without investing in oil investments themselves (e.g., possibly due to ESG limitations). The proprietary and patented analysis by MacroRisk Analytics allows such an endeavor.

Using the MacroRisk Analytics platform, this post will identify 5 stocks out of the Nasdaq 100 Index that are expected to behave similar to SPDR S&P Oil & Gas Explore & Production ETF (ticker: XOP) and 5 stocks that are expected to behave in an opposite direction.

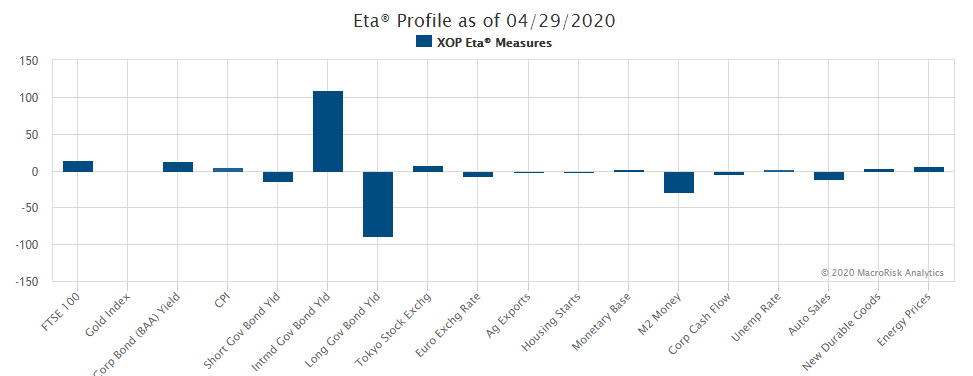

XOP is an ETF that tracks the performance of oil and gas production and exploration public companies. Using the XOP as a benchmark investment in oil, MacroRisk Analytics can identify potential investments that have similar or different economic exposures to XOP. The Eta® profile, by MacroRisk Analytics, demonstrates these economic exposures. The Eta profile of XOP is shown below:

If a bar is pointing up, the XOP price is expected to increase if that factor increases and vice versa. The magnitudes of the bars also show us the importance of the factors.

To identify our 5 Nasdaq stocks that are expected to behave like XOP, the MacroRisk Analytics platform would look for stocks with similar or opposite Eta profiles to that of XOP. It is very rare to find assets that have the same or opposite Eta profiles exactly but MacroRisk will select investments that are the closest to achieving the specific goal.

Some financial advisors may believe that the oil market would continue its rebound as the economies continue to reopen driving the demand for oil up and the OPEC countries not planning to increase supply. These factors are expected to apply upward pressure to oil prices.

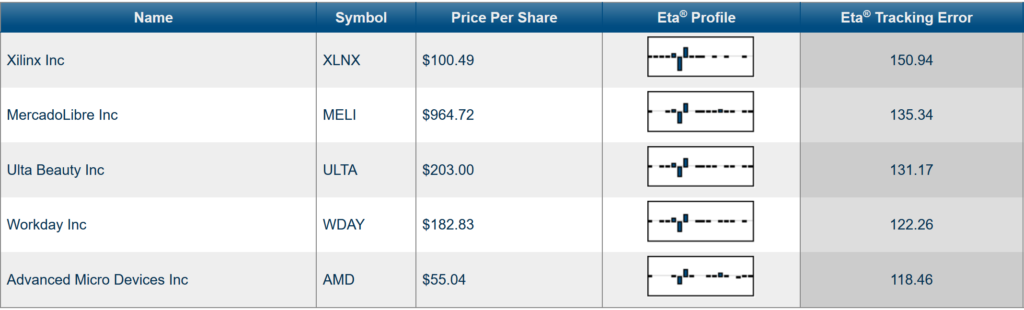

To this end, below are 5 stocks out of the Nasdaq 100 Index that are expected to behave as similar as possible to XOP ETF as of July 19, 2020 using the Eta® tracking error.

On the other hand, other advisors may believe that with the rise of Covid-19 cases in the United States, some states may take steps to slow or implement some economic shutdowns again. This is expected to decrease the demand for oil as economic activity decreases.

To this end, below are 5 stocks out of the Nasdaq 100 Index that are expected to behave as different as possible to XOP ETF as of July 19, 2020 using the Eta® tracking error.

The Investment Ideas Generator by MacroRisk Analytics was used to identify stocks mentioned in this blog post. This tool provides a unique way for financial advisors to find proxy investments out of a buylist (as we just did for oil using Nasdaq 100 stocks) because some advisors may not even be able to take a position in oil-related stocks due to ESG limitations, for example.

Whether you are interested in analyzing oil investments as stand-alone assets or in a portfolio setting and with the economy in mind, MacroRisk Analytics can assist with this as well many other investment analyses. MacroRisk Analytics provides analysis for thousands of stocks, mutual funds, ETFs, and other assets. For sign up, visit http://www.macrorisk.com/subscriptions/.

Some of the MacroRisk Analytics® analysis has been utilized by the Rational Equity Armor Fund (ticker: HDCTX) starting in December of 2019. For more information about the fund, click here.

Mr. Rolland Harris assisted with the preparation of this post.