Recently, many of us had probably noticed that when the 10-year U.S. government bond yield increased, the Nasdaq-100 Index tended to drop in value. This post will demonstrate what other economic exposures of the Nasdaq-100 are using the patented 18-factor model created by MacroRisk Analytics®. Financial advisors and investors can use this information to better understand the risks and opportunities involved with an investment in the Nasdaq-100.

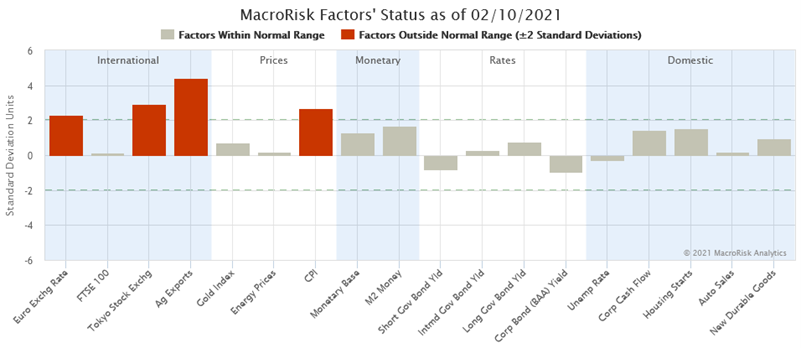

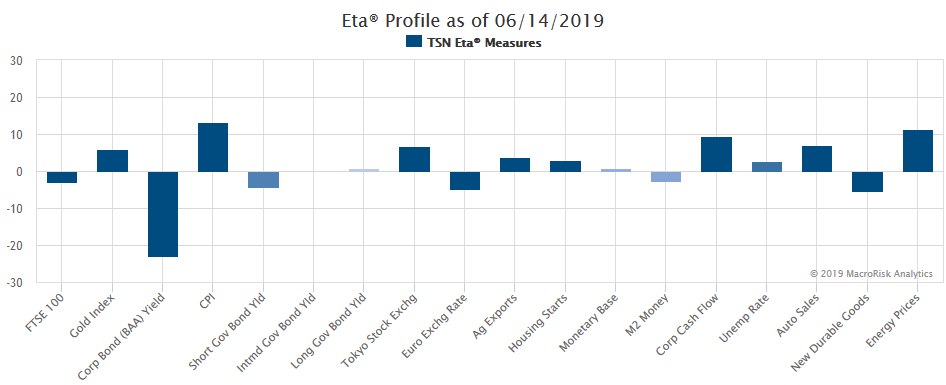

The MacroRisk Analytics model correctly identifies the relationship we had recently seen where the Nasdaq-100 would drop in value when the 10-year treasury yield increased. Using the Eta® Profile available on the MacroRisk Analytics platform, we can quickly identify this and other relationships the Nasdaq-100 has to other economic factors.

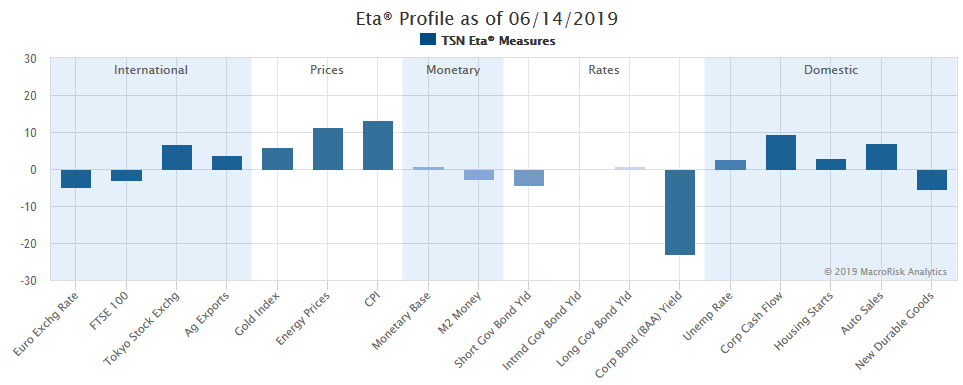

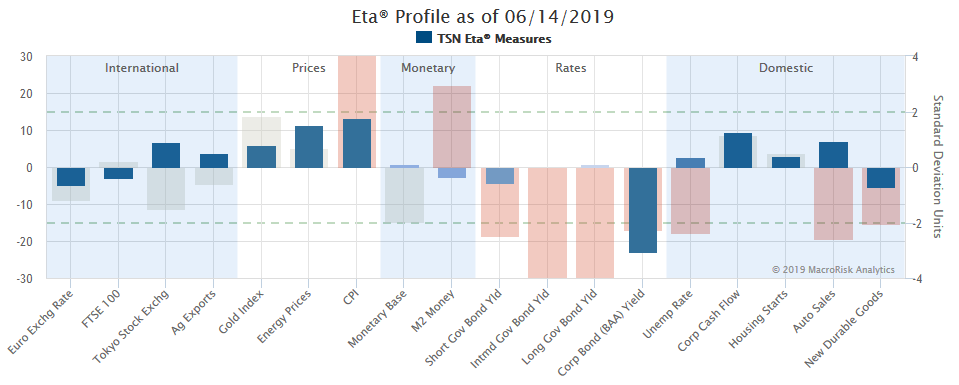

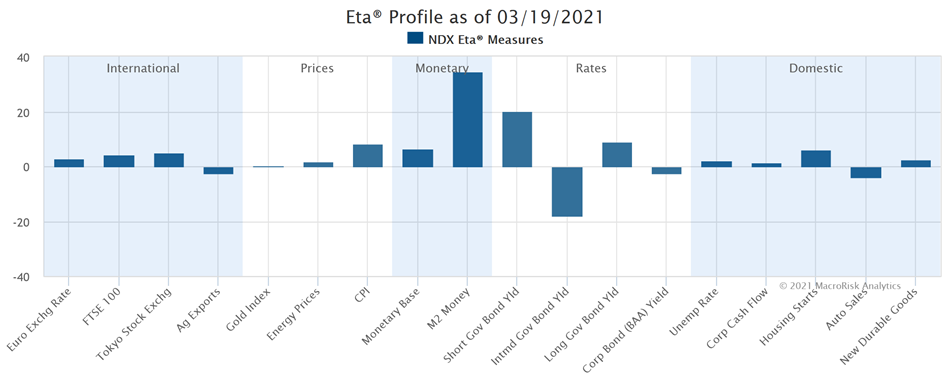

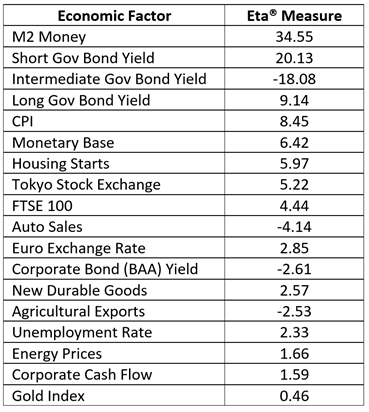

The Eta® measure in the graph below demonstrates the sensitivity of an asset to the economic factor. It reflects the expected change in an asset’s value given a one standard deviation increase in the economic factor. For instance, if the M2 Money factor increases by one standard deviation, the Nasdaq-100 is expected to increase 34.55% keeping other factors constant.

We can see that the Nasdaq-100 has a negative exposure to the intermediate government bond yield (i.e., the 10-year treasury yield). A negative exposure means that we can expect the asset to benefit if the economic factor decreases and vice versa. In other words, if the 10-year treasury yield increases, we can expect the Nasdaq-100 to drop in value holding other factors constant. This relationship is what we have recently seen happen in the market. While the chart above shows the economic sensitivities as of March 19, 2021, a similar relationship to the 10-year treasury yield existed at the beginning of 2021 before the interest rate spiked.

The chart also illustrates that the Nasdaq-100 does have other exposures to the economy, and in some cases, the profile deems these exposures to be stronger, more important exposures than the exposure to the intermediate government bond yield. For instance, we can expect the Index to have the biggest exposure to the M2 Money factor. This factor measures the money supply that includes cash, checking deposits, and easily convertible near money. In this case, the exposure is positive meaning that we can expect the Nasdaq-100 to benefit if M2 Money increases.

The Nasdaq-100 has the second largest exposure to the short-term government bond yield. This exposure is positive meaning that we can expect the Index to increase in value if the aforementioned factor increases and vice versa.

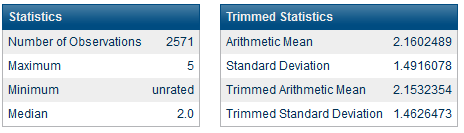

The table below demonstrates MacroRisk Analytics’ patented Eta® measures (i.e., economic sensitivities) of the Nasdaq-100 as of March 19, 2021. The table lists the sensitivities in descending order based on their absolute values.

This post’s goal was to help the reader understand the economic exposures of the Nasdaq-100 Index beyond what one may have deduced by observing the recent relationship between the 10-year treasury yield and its impact on the Nasdaq-100 value. Understanding the sensitivities of the Nasdaq-100 can help financial advisors and investors identify which economic factors are of more importance. This allows investment professionals to position their portfolios appropriately.

This post is possible thanks to MacroRisk Analytics®. This platform provides investment research for 30,000+ individual names as well as investor portfolios. The MacroRisk Analytics® model uses 18 macroeconomic factors to break down the economy’s impact on investment value. Using this patented research, our team has twice won the William F. Sharpe Indexing Achievement Award for ETF/Indexing Paper of the Year. Click here to access this award-winning investment research today! You can find our other blog posts by clicking here.

Edited by Rania Sullivan.